JAMIE DIMON LOVES INDIA

The annual J.P Morgan India Investor Summit was held recently in Mumbai, the financial capital of India, with emphasis on the outlook of the Indian economy and its future in the dynamic evolving global economies.

Jamie Dimon says India optimism is ‘completely justified’.

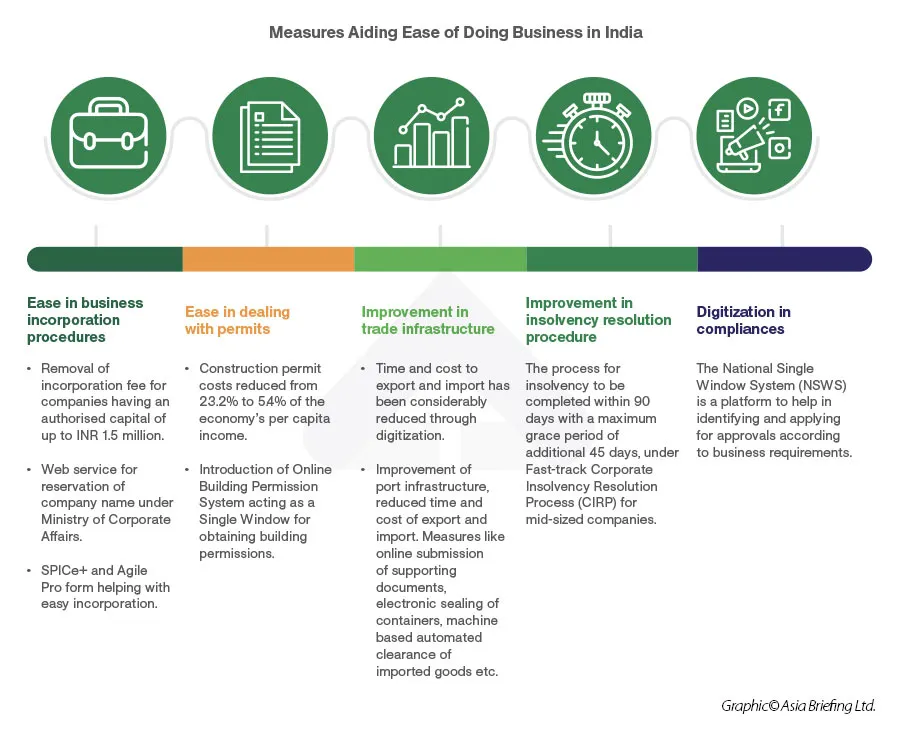

“You have done a lot of fabulous things like biometric identification, open and checking accounts, trying to develop infrastructure better, getting rid of bureaucratic regulatory burdens, it should be the fastest growing nation to play for the next 10 years. If you don’t, it’s because you did not do all the right things,” said Dimon during the JP Morgan India Investor Summit. Amazing examples of India making its own progress, including Aadhaar and GST. “I think the power of freedom of people and entrepreneurs is extraordinary. You see it in your technology here.”

According to Jaime Dimon, chairman and CEO of JP Morgan Chase, India will be the fastest developing country in the next ten years and the second largest destination for technology. India has developed considerably over time and is now the second largest destination for technology, according to Dimon, who also stated that the US wants to ally with India and collaborate on a variety of fronts.

“You have people like America who want to be your ally and partner in many more ways.”

JPMorgan Chairman and Chief Executive Jamie Dimon, said, “I am happy to be back here. I love coming to India, and have always learned so much. This is our eighth equity conference now. I’ve been coming since 2005. We’ve gone from some 6,000 employees here to over 50,000 and the global service centres now have everything. It used to be just call centres but now it’s everything.” added further that JPMorgan is one of the biggest international investment banks in the country and that the journey has been “extraordinary”.

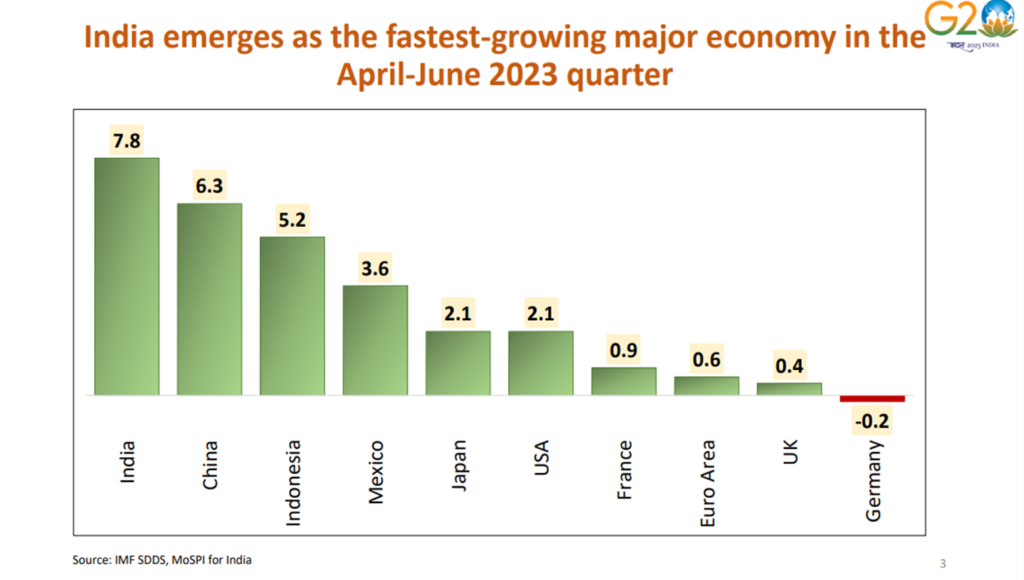

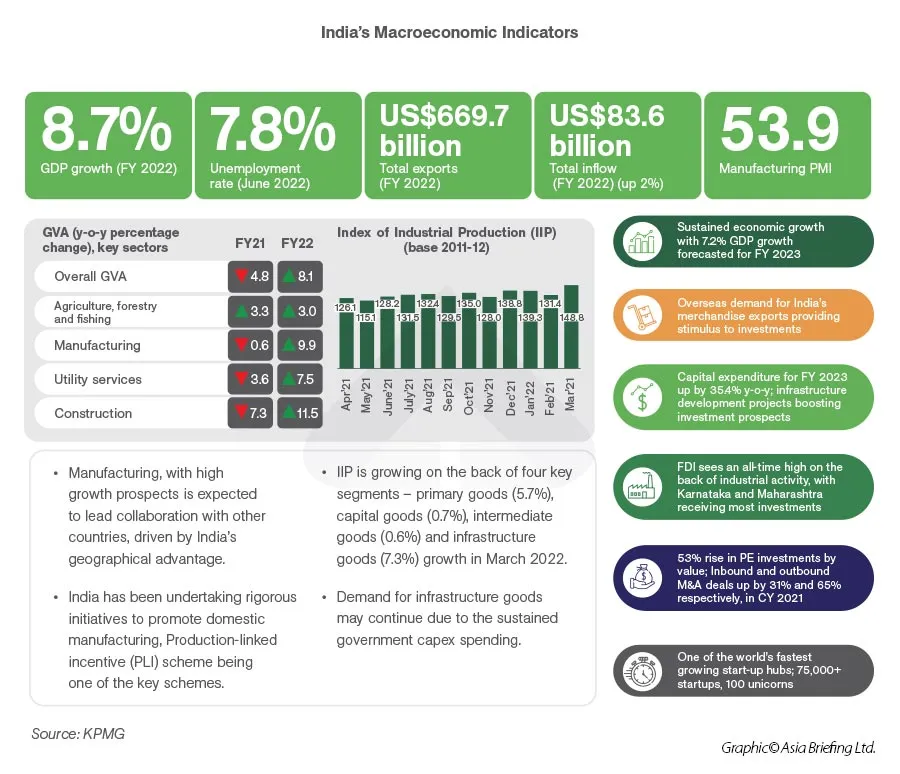

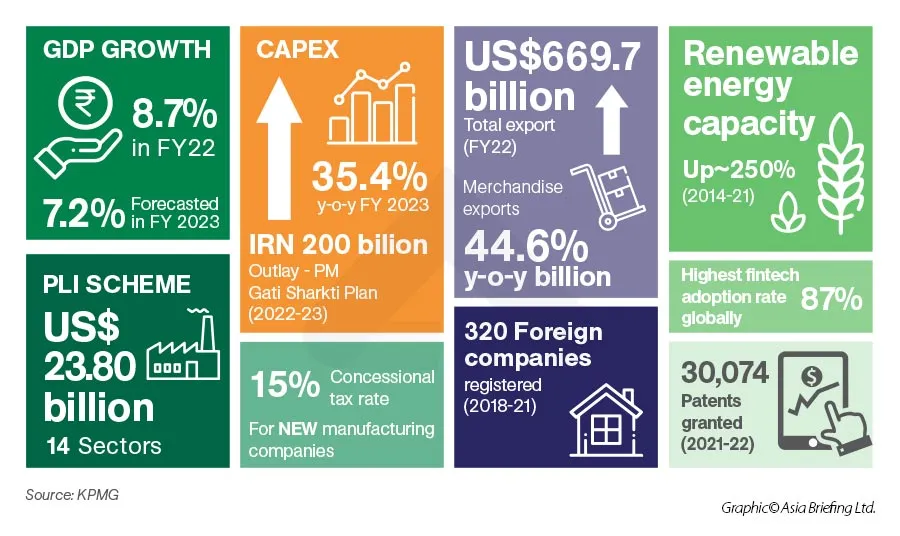

According to IMF projections, India’s economy would overtake Japan and Germany to become the world’s third biggest by 2027, with a GDP of $5 trillion. India wants to be a developed economy by 2047. India is anticipated to be the world’s fastest growing country by 2023, according to the G-20 grouping of the world’s major nations.

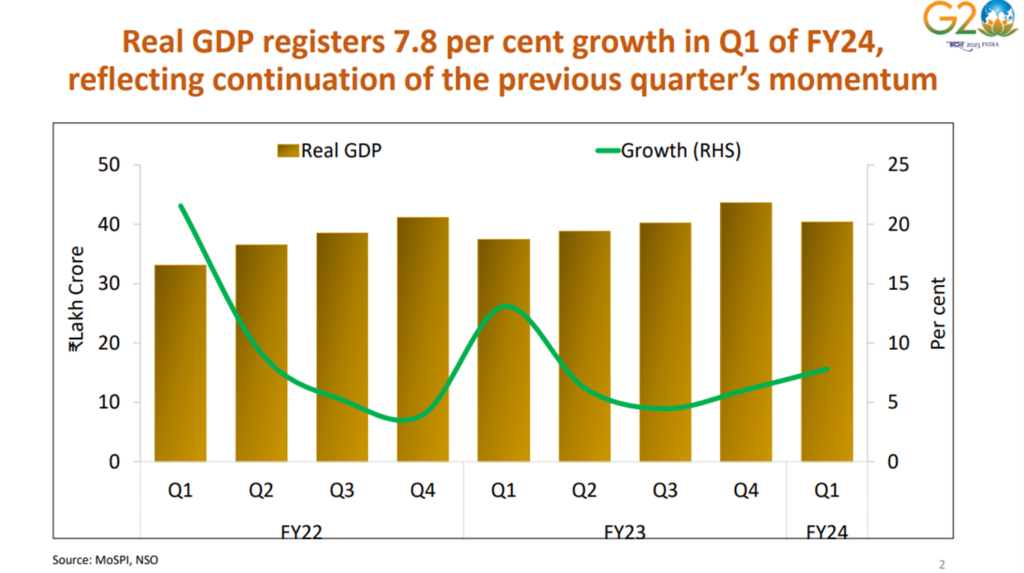

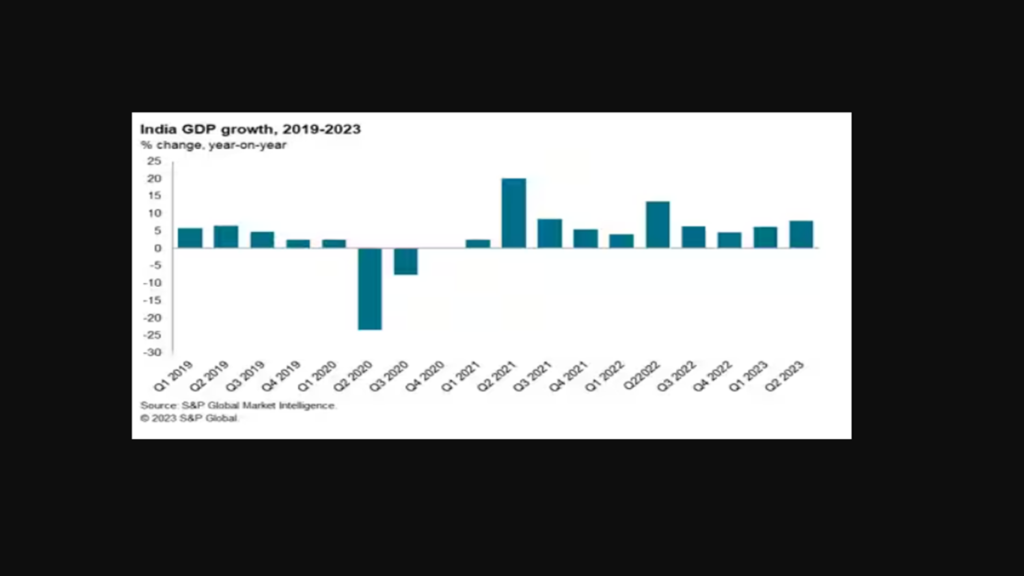

According to figures given by India’s National Statistical Office, GDP growth in India increased to 7.8% year on year in the April-June quarter of 2023, up from 6.1% year on year in the January-March quarter of 2023. Despite high base year impacts, the substantial growth rate was achieved following GDP growth of 13.1% y/y in the April-June quarter of 2022.

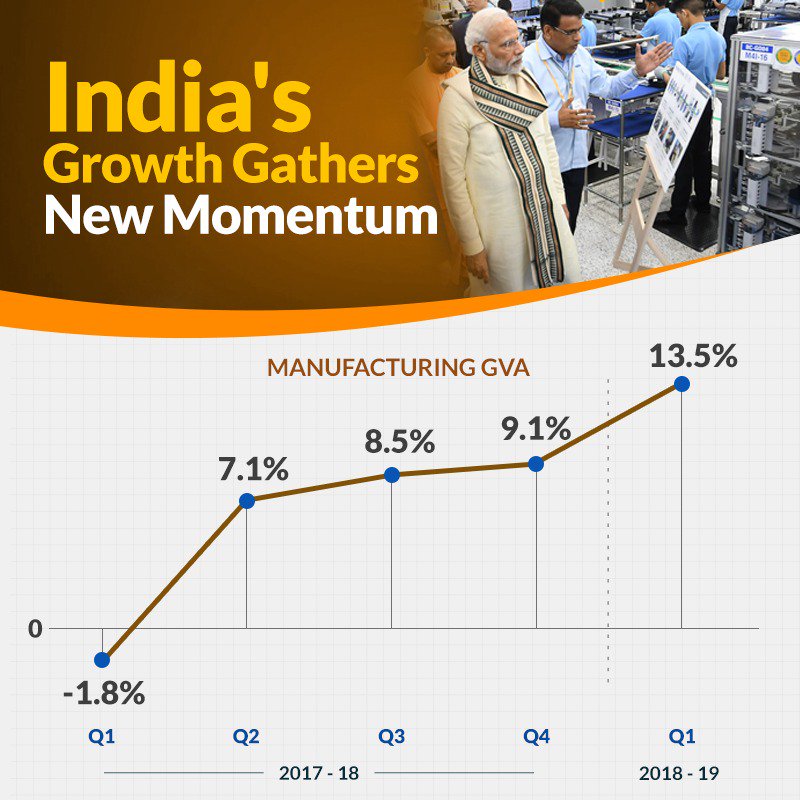

Dimon believes that when manufacturing moves away from China, India will benefit greatly. In recent years, India’s significance on the global economic arena has progressively expanded, particularly as Western countries seek to diversify away from China.

“Every company looks at supply chains that are going to have to diversify more and a lot of people say that China is not as secure a supply chain and therefore to move manufacturing to somewhere. And I think India could be a huge beneficiary of that.”

Since the outbreak of the COVID-19 epidemic and subsequent lockdowns, several Western companies have made no apologies about diversifying their supply chains, sometimes known as China plus one.

“It’s not just because of the complications with China, I think that’s an opportunity but some of this optimism would have been there anyway,” Dimon said.

“Look at this conference. I remember eight years ago or nine years ago we started with 50 or 75 clients. Now it’s 700 investors around the world, 100 companies presenting. I think the optimism of India is actually completely justified,” Dimon at the conference.

Dimon applauded Indian Prime Minister Narendra Modi for reviving the country’s economic climate, citing reforms that make it easier for Indian individuals to open bank accounts, streamline taxes, and attract international investment.

Dimon stated that the bank’s personnel base in India has grown very strongly. I’ve been visiting since 2005. We’ve grown from 6,000 to 60,000 people who travel the world and work. It’s no longer just contact centres; it’s everything from technology to analytics to cyber.

“The universe is [in India]. We’re not the only bank here, there are large other banks with a lot of people, but so is Accenture, McKinsey and obviously you have your local Tata, etc., so those things are driving optimism,” he said.

JP Morgan has grown tremendously in investment banking and the future is more of the same, in my opinion. When it came to the investment banking aspect of our company, we used to cover 10 or 20 firms and do research on them. Previously, we only banked 20 or 30 multinationals visiting India. We now bank 500 global corporations as well as all of your Indian enterprises in London, Singapore, and America, assisting them with financing, acquisition, and M&A. So, in the following 20 years, I expect them to double again.

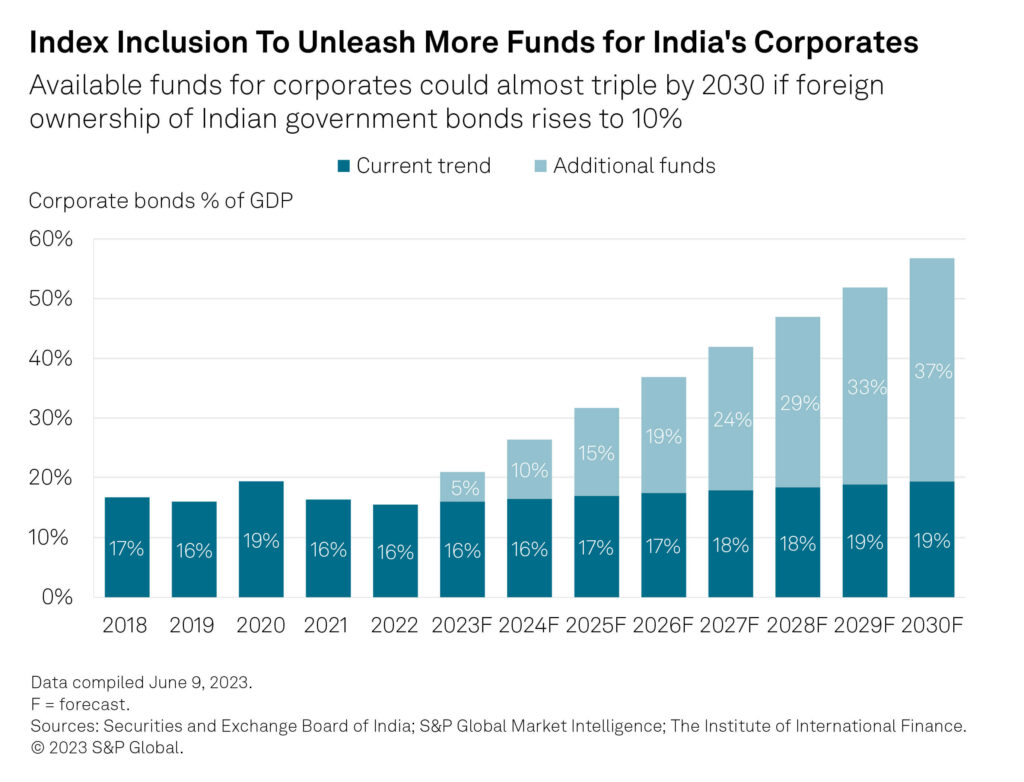

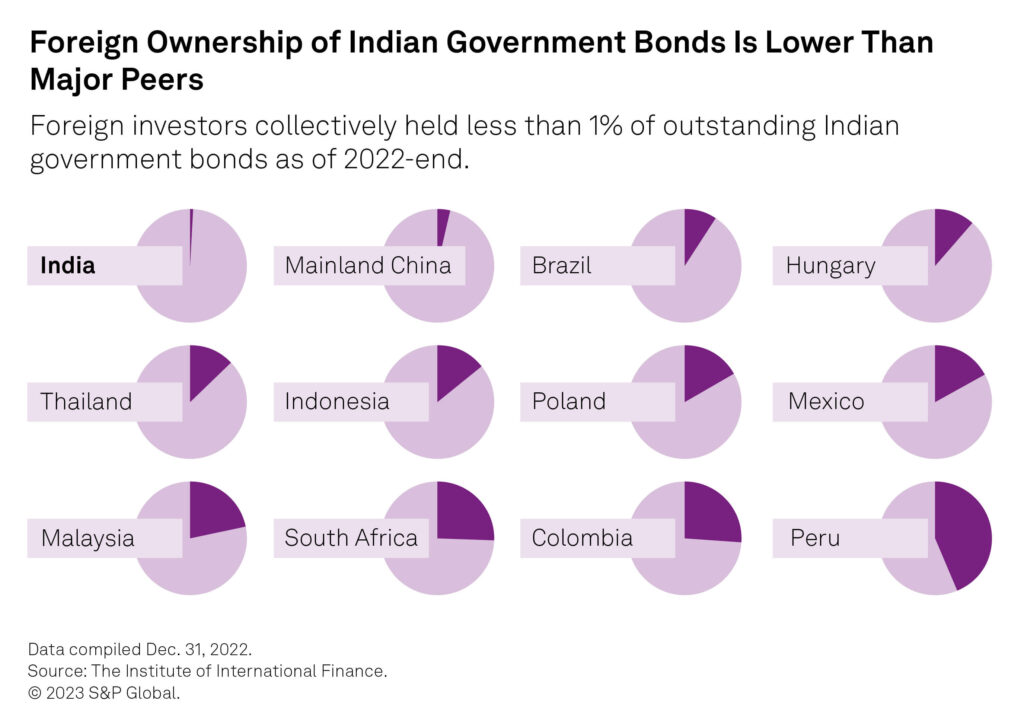

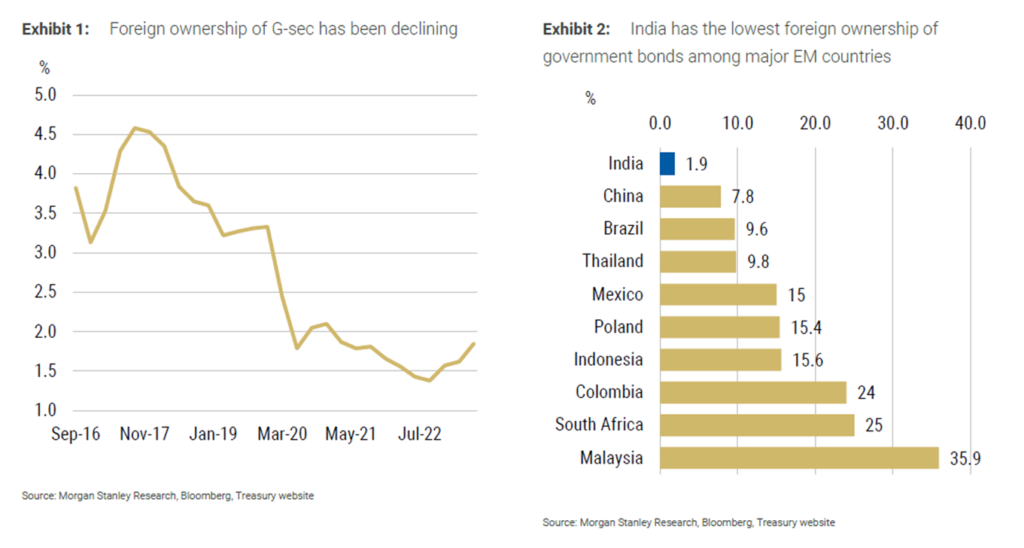

JPMorgan’s widely followed developing market debt index now includes India. Local bonds from India were included in the Government Bond Index-Emerging Markets (GBI-EM) index as well as the entire index suite. According to JPMorgan, 23 Indian Government Bonds (IGBs) with a total nominal value of $330 billion are eligible.

Dimon said the inclusion in the index is “great for the country” and in general “a very good thing,” a sign of maturity.

With INDIA been added to the JP Morgan Emerging Markets Bond Index, the estimates for inflows into India range from $25 billion to $40 billion over the next year and a half as the inclusion works its way out. Jamie highlighted, So our experts estimate a $25 billion influx. It needs to be purchased, thus it is acquired over time. But I believe it’s a fantastic thing to have an index like that because it indicates your capital markets, rule of law, openness, and government finance are all better off.

India will join the index with 1% in June 2024. The weight will increase by 1% each month until 10% in April 2025. India will be the second biggest EM country in the index, after China. Other EM countries’ weights will drop: Thailand (1.65%), South Africa (1.36%), Poland (1.27%), Brazil (1%), Czech Republic (1%), Colombia (0.78%), and Romania (0.65%). After the inclusion, Asia will account for almost 50% of the GBI-EM index.

What you require is capital, foreign direct investment in both plants and equity, as well as creative firms and other such things. So it’s simply one more extremely encouraging indicator.

India’s inclusion in the GBI-EM Global index suite attests to the country’s success in economic reforms as well as its growing reputation in the global financial market. Beginning June 28, 2024, India will be included in the GBI-EM Global index suite, with a maximum weight of 10% in the GBI-EM Global Diversified Index (GBI-EM GD), reflecting India’s rising prominence in the global bond market. The addition of Indian government bonds will be phased in over a 10-month period, ending on March 31, 2025, to ensure a seamless transition into the index. India’s weighting in the JPMorgan benchmark index, which amounts for $213 billion in assets, will reach a maximum of 10%. The bond market in India is valued more than $2 trillion.

Foreign investment may provide a significant source of money for critical infrastructure projects such as the construction of roads, bridges, schools, and hospitals. It also has the potential to lower the country’s current account and budgetary imbalances. As a result, India’s cost of borrowing will be decreased, the liquidity and ownership base of G-secs would be expanded, and India will be able to finance its fiscal and current account deficits. Lower borrowing rates may help infrastructure projects and promote more efficient market conditions.

The addition of India in the index shows the country’s rising prominence as a market for global investors, particularly as they seek alternatives to China and other emerging nations. It elevates India to the ranks of the world’s best-performing countries, encouraging foreign portfolio investments and elevating the country’s global economic standing.

On AI driving JPMorgan’s future, Jamie said, We’ve got 1,000 people working on it. AI is real. We’ve got 300 use cases in marketing and fraud risk when we’re moving $10 trillion in daily transactions through AI systems. Every application, every role, every human being will be impacted. And don’t forget, criminals can use it, too. So we need to be ahead of criminals in voice recognition, data usage, and even cyber. So it’s going to be good for humanity. It’s also going to be disruptive, and I think governments need to be prepared for that, but they can’t stop it. So I think it’s a huge plus for humanity, but I totally understand people’s concerns about the downside.

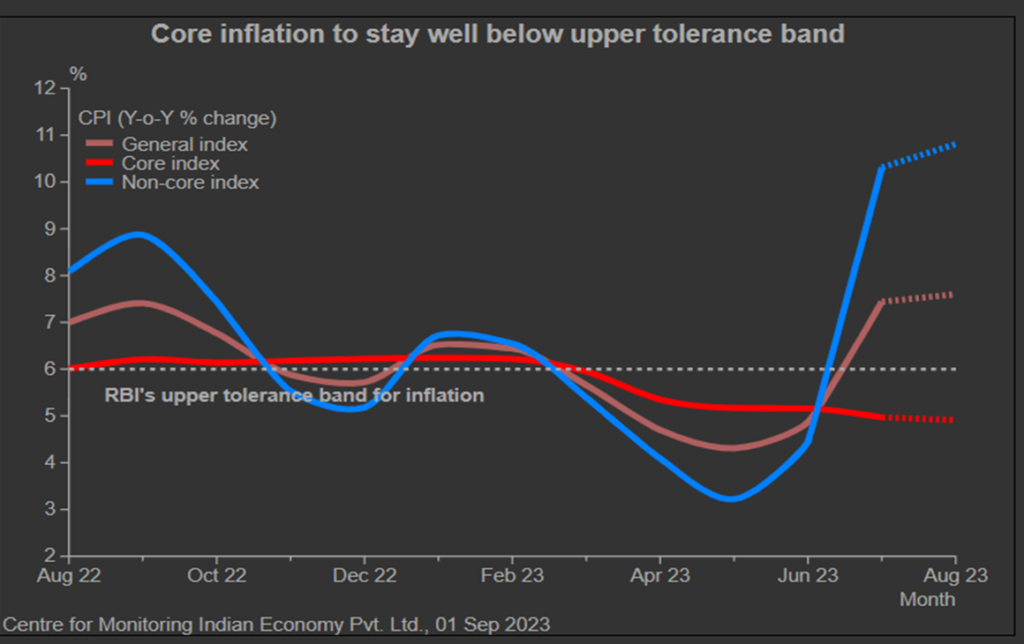

Jamie said on higher rates and inflation, I think it’s more likely that it won’t, but again I think people need to prepare for higher oil prices, higher interest rates, just to be prepared. We can all guess what it’s going to be. I don’t know, nobody knows, but I think the probability is higher than that. But hopefully, we’ll get through it. Geopolitical issues are the biggest concern for me. We don’t even know how it will affect the economy yet. But again I think the humanitarian aspect is much more important.

It’s also very important to me that we may be at a moment of inflection for the Free Democracies. That’s how serious I am. And geopolitics is the number one risk and we haven’t really seen something like this pretty much since World War II.

Anu Aiyengar, global head of mergers and acquisitions at JPMorgan Chase & Co., disclosed that investors had around $2 trillion in accessible cash for investment. Of this total, $100 billion to $150 billion is earmarked for India.

Aiyengar expressed confidence about India’s investment landscape, adding that the combination of capital inflows and successful financial sponsor exits bodes well for additional investment in India.

“As we look at a combination of the inflows into the Indian market, as well as the exits financial sponsors have successfully been able to do, that bodes well for more money getting deployed in India,” Aiyengar said at the JPMorgan’s India Investor Summit in Mumbai.

“It is hard to find a market like this which has the growth characteristics and stability as well as tech, health care and infra solutions that are being provided by a multitude of companies,” Aiyengar added.

Aiyengar also identified infrastructure and energy transformation as major drivers of M&A in India. “You have multiple infrastructure-only funds that are now getting set up, and the infrastructure spend in India is substantial,” she said.

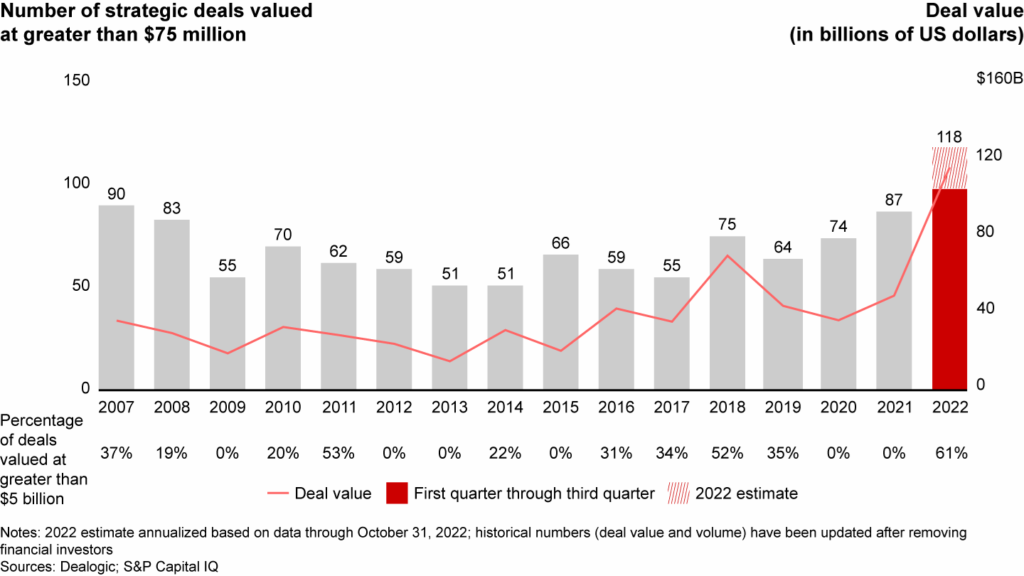

In contrast to the global downturn in dealmaking activity in 2023, India has witnessed $33 billion in M&A deals so far this year, despite a 72% drop from the same period in 2022. JPMorgan rose from third position in M&A volume in 2022 to second place globally this year.

In the present relative quiet of the IPO market, Aiyengar sees optimistic evidence for asset owners’ exit options. She believes that dual-track deal making will become more widespread, allowing asset owners to compare values in the public and private markets and consider both IPOs and M&A transactions as possibilities for selling their assets.